Islamic Banks and Financial Institutions Information System IBIS 2 Iqbal 2001 Journal of Islamic Economics Banking and Finance 3. The Islamic banks so far have undertaken extensive research in devising non-usurious procedures to utilize their funds.

The Impact Of Monetary Policy On Islamic Bank Financing Bank Level Evidence From Malaysia

The Challenges are manifold.

. Circumstance the aim of this paper is to identify major regulatory challenges faced by Islamic Banks in the cross border activities over the world. The widely held expectation that this superior growth record will continue is understandable given that approximately one-sixth of the. Currently Malaysia has three local full-fledged Islamic banks five foreign owned entities and eight conventional banks who have established Islamic subsidiaries.

Current Challenges In Malaysia In the Malaysian context the government has outlined 10 key principles of Islam Hadari which will also be the 10 challenges faced by Muslims. However there are few challenges faced by the SAC in executing their roles. Implementing Islamic banking in Philippines.

However Islamic banking and financial institutions are facing some great challenges in the Malaysia because the conventional financial system is more beneficial. It has tremendous potential to grow further in future. Palabrica - June 11 2019.

Being resilient is always a challenge for the Banks especially with so many moving parts in the financial world. Tools to Attract Depositors. New regulations new competition new structures new products and new models continue to plague the banking industry.

To change our mindset to make Banking and Financial Market more better requires a. Challenges Facing Islamic Financial Industry. According to RAM Ratings Malaysia was the top sukuk issuer with US139 bil ringgit equivalent or 351 of the US395 bil ringgit equivalent sukuk issued.

The lack of available expertise compliance with new regulations investors confidence and market conditions are key challenges limiting investment. Islamic banking challenges. Pure-play Islamic Banks and financial institutions manage over 250 billion of assets and a further 200- 300 billion is managed by the Islamic windows and subsidiaries of international banks.

The study found that Islamic banking is facing challenges to make. Challenges facing Islamic banks. As more Islamic Financial Institutions IFIs were introduced in Malaysia SAC was established at the national level to ensure uniformity and consistency for approving new Islamic products.

PDF On Jan 1 2019 Hani Omar and others published Challenges Faced by Malaysian Islamic Banks in Treating Shariah Non-compliance Events Find read and cite all. This paper evaluates the issues challenges and prospect of this emerging industry and ends with suggestions and recommendations on how they can be addressed for. The first challenge is on the requirement of talents to master both the theories and practical of Islamic banking and finance.

Islamic banks operating in Malaysia under the supervision of BNM. The challenges facing Islamic banking. This chapter seeks to study the issues and challenges faced by Islamic microfinance institutions in the Malaysian context.

Islamic banks at least in Saudi Arabia and Egypt have departed from using profit-loss-sharing techniques as a core principle of Islamic banking according to a 2006 dissertation by Suliman Hamdan AlbalawiMalaysia has also seen a decline. Even the number of talents registered at local universities is growing however to cultivate talents. The growth of Islamic banking has outstripped that of conventional banking in recent years with total Islamic banking assets crossing the US15 trillion mark in 2013.

In oil producing jurisdictions offering Islamic finance the industry faced further shock from the plummeting oil price and suspension of infrastructure projects. Malaysia has recorded 173 growth of Islamic finances market between 2009 -2014 MIFC 2015a. Full list of these Islamic Banks can be referred in Table 1 under Discussion Section of this paper.

The plunge in global economic growth and the continuing uncertainty as to when the pandemic will end will no doubt pose a challenge on the Islamic finance industrys profitability. With these features of the Islamic banks the following issues arise. Islamic banking industry with reference to credit risk operational risk and Shariah risk Section 4 deals with the issues and the challenges faced by Islamic banking in the area Section 5 discusses the risk mitigation strategies and the final Section 6 contains some concluding remarks.

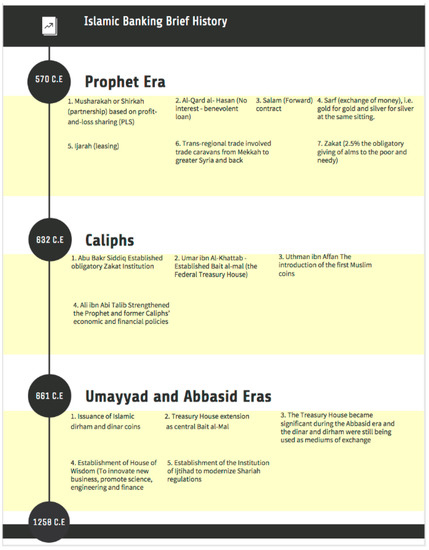

This was followed by Bank Islam Malaysia Berhad BIMB in 1983 which marked the beginning of commercial financial institutions offering Islamic products and services to consumers. 8 Bank Muamalat Malaysia Malaysia 3813 202 9 Qatar Islamic Bank Qatar 3035 500 10 Sharjah Islamic Bank UAE 2081 515 Source. However there are a.

To achieve this goal Islamic asset managers need to compete with conventional institutions by providing both attractive yields and a superior level of service quality and product customisation. In accordance with Islamic law any element of usury must be avoided entirely in economic transactions hence resulting in the imposition of management fees on the borrowers instead of interest. This week I intend to write about five key growing challenges that are consistent with the industry in Malaysia.

Islamic banks shall be licensed and regulated by the MB in the same manner as universal banks and have to comply with existing banking requirements on among others capital adequacy liquidity corporate. The establishment of Muamalat Court was one of the challenges faced. It is purely a descriptive presentation on the issues of regulatory challenges in the cross border operations.

ISLAMIC banking industry has been trying for the last over two decades to extend its outreach to bring it at least to the level of conventional banking. I Faith and Piety to Allah ii Just and Honest Government iii Liberated People iv Mastery of Knowledge v Comprehensive and Balanced Economic Development vi Quality. Very little research has been done in devising the tools to attract deposits.

The Islamic finance industry in Malaysia is characterised by having comprehensive market components ranging from Islamic banking takaful Islamic money market and Islamic capital market. One study of which modes of Islamic finance were used most frequently found PLS financing in leading Islamic banks had declined from.

Jrfm Free Full Text Developments In Risk Management In Islamic Finance A Review Html

Pdf Islamic Finance Operational Transaction Framework A New Insight Of Islamic Finance Implementation In Malaysia And Japan

Connecting Malaysia S Islamic And Sustainable Finance To The World

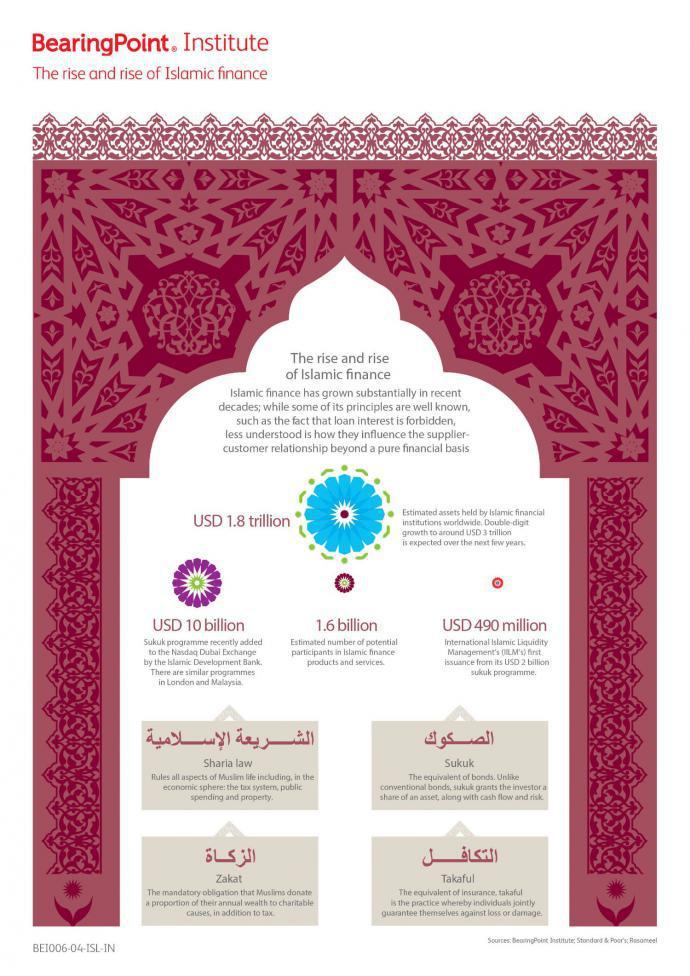

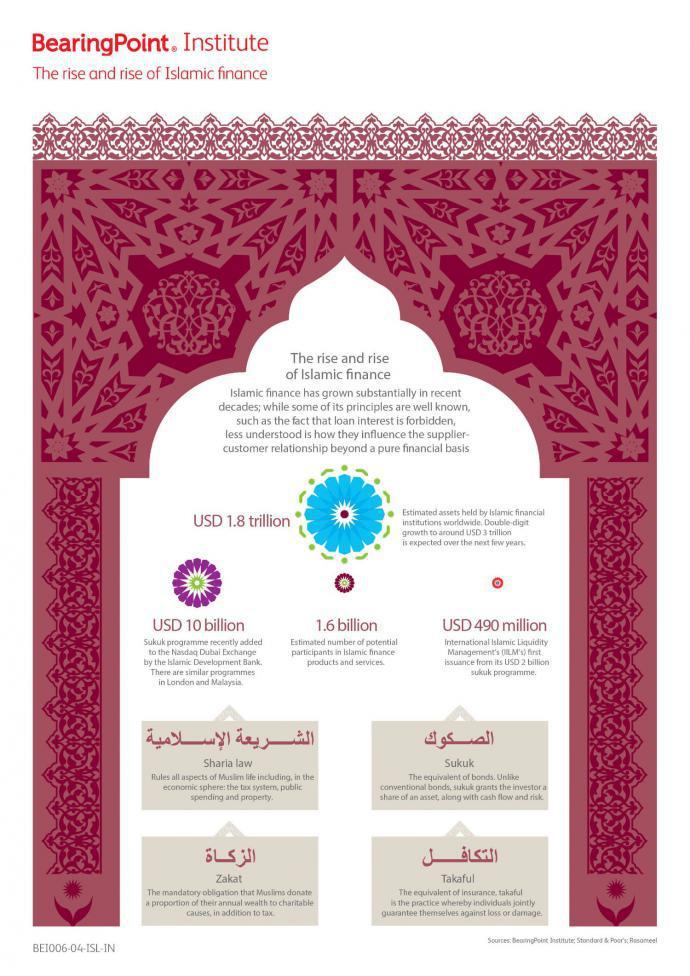

The Rise And Rise Of Islamic Finance Bearingpoint

Basic Rules Of Islamic Finance C Download Scientific Diagram

Pdf Performance Of Islamic And Mainstream Banks In Malaysia

The Impact Of Monetary Policy On Islamic Bank Financing Bank Level Evidence From Malaysia

Islamic Finance In Africa Opportunities And Challenges White Case Llp

Imf Survey Islamic Banks More Resilient To Crisis

The Impact Of Monetary Policy On Islamic Bank Financing Bank Level Evidence From Malaysia

Imf Survey Islamic Banks More Resilient To Crisis

Pdf Emerging Issues In Islamic Banking Finance Challenges And Solutions

The Impact Of Monetary Policy On Islamic Bank Financing Bank Level Evidence From Malaysia

List Of Islamic Banking Institutions In Malaysia Download Table

Imf Survey Islamic Banks More Resilient To Crisis

Sustainability Free Full Text Alignment Of Islamic Banking Sustainability Indicators With Sustainable Development Goals Policy Recommendations For Addressing The Covid 19 Pandemic Html

The Impact Of Monetary Policy On Islamic Bank Financing Bank Level Evidence From Malaysia

The Impact Of Monetary Policy On Islamic Bank Financing Bank Level Evidence From Malaysia

The Impact Of Monetary Policy On Islamic Bank Financing Bank Level Evidence From Malaysia